Following the recovery from the financial crisis, Russians have been spending substantially to catch up with a large backlog of demand. The food retail market in Russia is forecasted to grow around 20.5 percent per annum for the next few years. There are specific types of products that are expected to perform particularly well.

Food Products

Meat: Due to the lack of domestic supply, Russia is one of the world’s major meat importers. Russia imports over two million tonnes of beef, pork and poultry meat annually. Russia also has a population of over 20 million Muslims who have a preference for lamb. This is a segment that offers enormous potential for Spanish meat exporters.

Meat: Due to the lack of domestic supply, Russia is one of the world’s major meat importers. Russia imports over two million tonnes of beef, pork and poultry meat annually. Russia also has a population of over 20 million Muslims who have a preference for lamb. This is a segment that offers enormous potential for Spanish meat exporters.- Fish and Seafood: The domestic Russian fish catch has grown in recent years. But due to high demand, there are many opportunities in this sector for Spanish fish and seafood suppliers.

- Convenience & Fast Foods: As Russian consumers lead busier lifestyles due to urbanisation, they are demanding more convenience products and fast foods. Canned, frozen and chilled food products all experienced growth rates of over 12 percent in 2009 despite the economic recession.

-

Healthy & Organic Foods: Russia’s population is aging and becoming more health conscious so the demand for healthy and organic food products has slowly increased in urban areas. Products such as yoghurt, muesli and low-fat alternatives have been growing faster than the overall food market.

While convenient or healthy food products can be sold at a premium, Russian consumers are price conscious and have become more conservative with spending since the global recession. Consumers generally are brand conscious but they will still switch products if prices change. Despite this, marketing and branding are becoming increasingly important to attract customers.

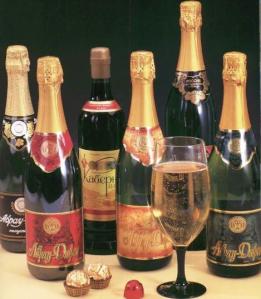

Beverage Products

Most beverage products decreased in sales volume in 2009 but inflation caused the overall sales value for many products to rise. Beverages that are rising in both volume and value sales include tea and functional drinks.

Most beverage products decreased in sales volume in 2009 but inflation caused the overall sales value for many products to rise. Beverages that are rising in both volume and value sales include tea and functional drinks.The Russian government is intending to reduce the number of wholesale licences for alcohol. This may cause difficulty in importing alcoholic beverages into Russia as some existing wholesalers and distributors will lose their licence.

Wine: Even though Russians in urban areas are increasingly purchasing wine, wine consumption is still quite low. The per capital consumption of wine in 2009 was 8.3 litres (whereas in the UK, this figure is 28.4 litres). The wine consumed is mainly from Europe, particularly France and Italy. New World Wines (from Chile, Australia and Argentina) are also becoming more popular. Upscale hotels and restaurants in the metro areas are specifically looking to offer internationally recognised wines, particularly well known brands and icons.

Export – Import Russia Forms of business entitiesBusiness Etiquette and protocol Russia. Export. Import. Export meetings in Russia. Etiquette Tips. How to handle a meeting? Export – Import General Business Tips Export – Import. Business Tips Uruguay Export – Import. Business Tips Chile Export – Import. Business Tips México Export – Import. Business Etiquette Peru BRAZIL. BUSINESS TIPS